Despite the new government advertising pompously an era of change, public distrust in our law enforcement agencies and justice mechanisms pursues its dizzy plunge down the abyss. As a matter of fact, every investigation is used to deflect attention from issues of the common man by providing uninterrupted entertainment like the daily catwalks at the Reduit Triangle. While these shows allow temporary quenching of the lynch mob’s thirst, they chew off the credibility of institutions. The investigation into the EASTCOAST deal, does stand as one of those milestones of our history reminding us, no matter the drought, pastures will remain evergreen for sacred cows.

In most newsrooms the mere mention of certain names is absolutely forbidden. A practice sharing clear resemblance with the Cosa Nostra’s omerta. While narrative spun by every media has lured public opinion onto an alleged overpayment of MUR 300 m to cronies, no one is willing to dig into the endgame of the EASTCAOST deal. Any diligent investigation should start with a proper understanding of the backdrop of the alleged crime. Let’s plunge into the forbidden !

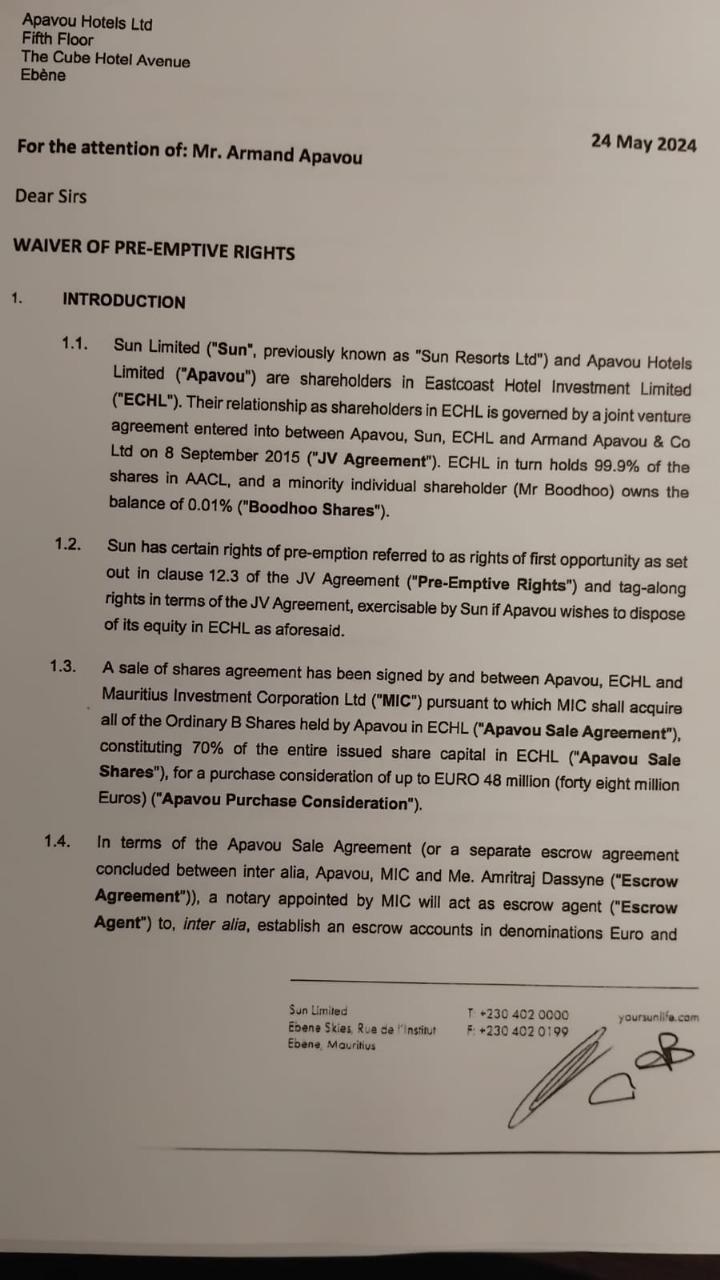

In 2011 Armand Apavou entered into an agreement with SUN Ltd for the management of Ambre Hotel. Once ranked as the richest businessman of France, Armand Apavou’s group glided downhill and was placed into administration by French authorities in 2015. The dire financial stress led Armand Apavou to propose Sun Ltd ( CIEL Group) a deal consisting of an up front payment of remaining lease at a significantly reduced fee. The sole shareholder of Apavou Holdings Ltd (AHL) claims that SUN Ltd took advantage of his situation and narrowed him down into parting away with 30 % of shares in Ambre against a discounted offer of EUR18m (MUR 0.67B). In the agreement, SUN locked Apavou with pre-emptive rights and right of first opportunity in any sale and with tag/drag along rights.

In 2021, again tangled in a financial turmoil AHL sought, but to no avail a MUR 1,2 bn facility from commercial banks and also the Mauritius Investment Corporation (MIC), despite pledging its 70% shares in EASCOAST Ltd. That was also the period when the lease agreement between AHL and SUN for management of Ambre had reached expiry. While Armand Apavou insisted on Sun Ltd vacating the premises, SUN ltd applied for an injunction in the Supreme Court to continue to operate Ambre. The sequence of actions between both parties does offer a vibrant picture of the intensity of the battle. In 2023 an ingenious tactic further delayed the eviction of SUN Ltd. SUN applied and obtained the right to an arbitration. The chosen arbitrator was none other than former chief justice Asraf Ally Caunhye. Despite pushing hard for arbitration, SUN Ltd never made a single submission and the blank arbitration served its intended purpose of buying time.

The matter took a swift turn in December 2022 when Armand Apavou floated an Expression of Interest (EOI). Reacting quickly SUN Ltd issued a Mise en Demeure to Armand Apavou and his advisors reminding them no sale could be effected without their consent. Simultaneously the EOI was met with a blockade from industry operators.

Meanwhile the MIC was progressing in its assessment of the EASTCOAST’s offer and in document submitted to the board by the Investment Committee with reference MIC/Ambre/ 2022/10/113 it is explicitly stated at page 4 that MIC may consider :

- To acquire 70% of Eastcoast’s shares and lease the Hotel to SRL on new terms which guarantee an annual inflation-indexed rental yield of at least 8.5% on the imputed transaction value of the Hotel, with Ciel Ltd as guarantor; or

- To acquire 100% of Eastcoast’s shares and lease the Hotel to another operator on same terms as option 1.

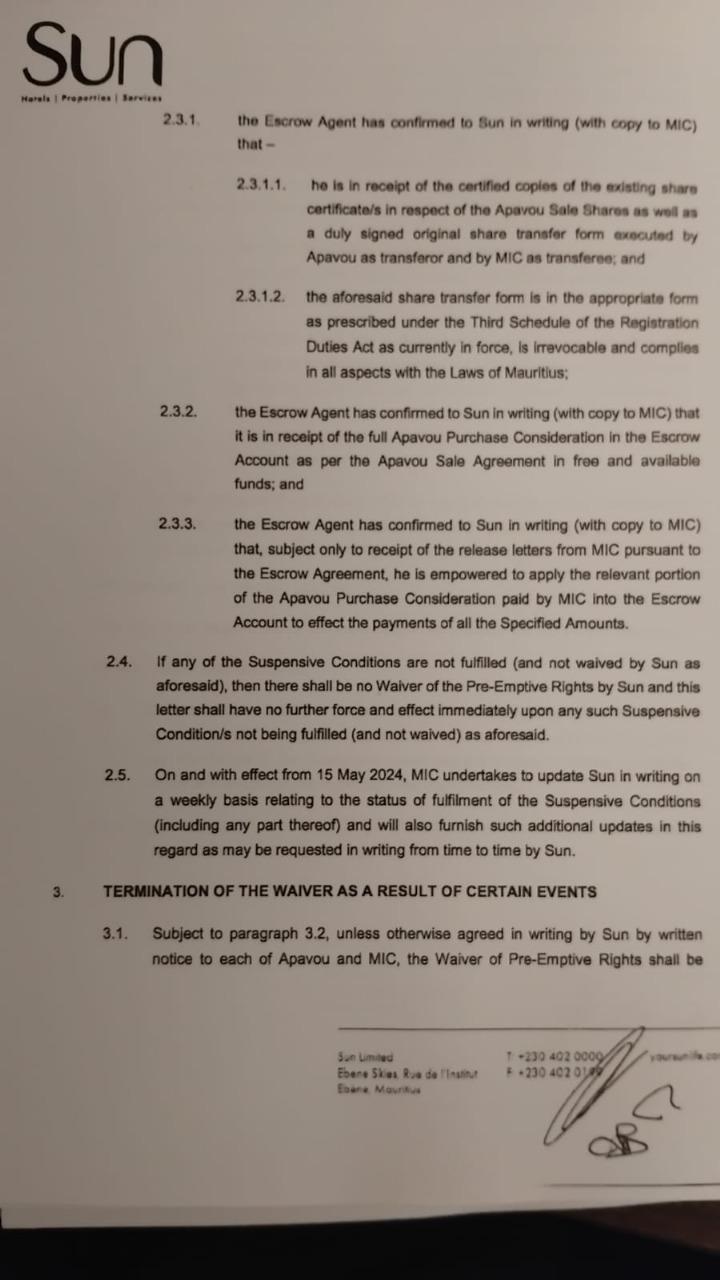

Which implies the Investment team of MIC was even considering an outright acquisition of ECHIL and leasing of the property to an operator other than SUN Ltd. An idea which surely sent shivers down the spine of those eager to tighten their grip onto Ambre hotel. What followed was a string of compromises between parties which led to SUN Ltd waiving its right to first opportunity in favour of MIC as to enable the acquisition of 70% of shares in EASTCOAST Ltd and a rental yield of at least 8.5% in euros.

The acquisition of 70% of EASCOAST was in line with the revised mandate of MIC aiming to be an active investor and owner, aiming to deliver sustainable value over the long term . What is beyond understanding is the manoeuvre by management of MIC to jeopardise its own interest by holding parallel negotiations with SUN Ltd, surrendering its rights and conceding control over EASTCOAST. Should there have been any negotiations with SUN Ltd it would only make sense had it solely pertained to renewal of lease as operator. No investor in his right mind would have forked out millions of euros merely to be a minority partner playing in the hands of SUN Ltd. Would the board have approved had the initial proposal been EUR 34 m for 49% of EASTCOAST ? Doesn’t it defy the very logic of “an active investor and owner, aiming to deliver sustainable value over the long term” ? Why did the MIC nor the Bank of Mauritius (BOM) represented by both deputy governors, show concern that SUN Ltd being a listed entity never informed the Stock Exchange of Mauritius ( SEM) of ongoing negotiations ?

|  |

|  |

| |

Stupidity vs Collusion

Following the time line of events going back to 2015, it would be reasonable to believe SUN Ltd had a motive in overcoming the toxic relations with Armand Apavou all while protecting its interest by securing control over the prized Ambre Hotel. It is also clear for obvious reasons Armand Apavou was unwilling to sell his shares to SUN Ltd. Why shouldn’t it be judicious to believe that MIC has been fooled into bridging the acquisition EASTCOAST Ltd and ensuring majority control by SUN Ltd ? A careful look at the figures would enable us to observe that SUN Ltd has acquired 51% of shares in EASTCOAST for EUR 32,4m while MIC has acquired 49% of shares for EUR 34 m. Even more glaring the payment made to Mr Mohammad Hasham Boodhoo for acquisition of his 1 share ( not to be confused with 1%) for a total of MUR 26 000 000. Assuming there was no ill intent from the management of MIC conducting the negotiations, why no premium was imposed on SUN Ltd for the 1% share which confers controlling powers? Is Mr Boodhoo a better negotiator than Mr Bisessur ?

The distribution of payment

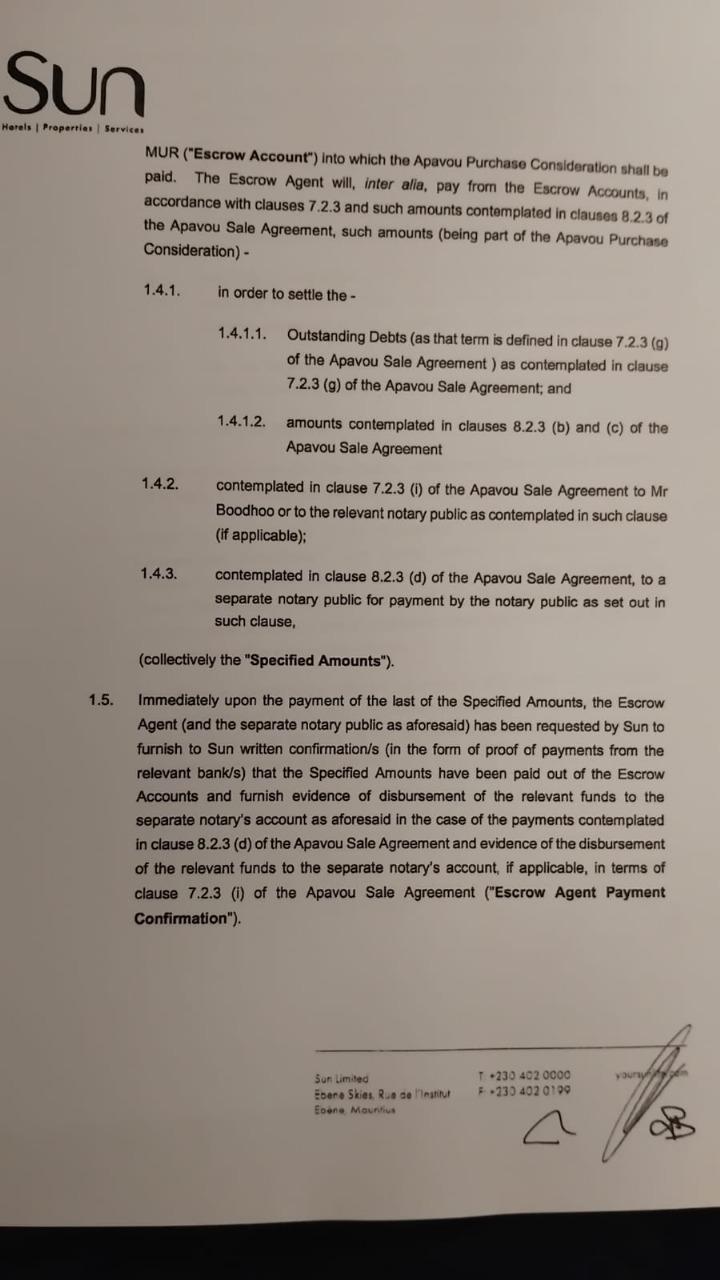

Contrary to what the media purports no payment was effected directly to neither Armand Apavou nor his advisors. The payment term agreed upon was 50% of the agreed amount in EUR and remaining 50% in MUR. Payment was effected to escrow account held by notary Amitraj Dassyne ( jointly appointed by MIC and AHL) and payment effected from the accounts are as follows :

EUR Account

28 May Notary Fees - EUR 272,000.00 (MUR 13, 719, 680)

31 May SBM – CALPA LTD/PELOUSE - EUR 4,300,000.00 (MUR 216,892,000)

20 JUN KEMP CHATTERIS - EUR 9,200.00 (MUR 464,048)

20 JUN KEMP CHATTERIS - EUR 12,075.00 ( MUR 609,063)

20 JUN KEMP CHATTERIS - EUR 17,250.00 (MUR 870,090)

Total - EUR 4,610,525.00

MUR Account

11 JUN MRA - MUR 649,161,588,00

11 JUN MRA - MUR 28,845,000.00

17 JUN CWA -MUR 194,462.96

17 JUN CEB - MUR 238,564,00

20 JUN GOVT OF MTIUS (MOL&H) - MUR 66,346,531.20

20 JUN GOVT OF MTIUS (MOL&H) - MUR 1,761,126.77

20 JUN CIEL CORPORATE SERVICES - MUR 75,000.00

21 JUN MIC - MUR 1,400,000.00

25 JUN HASSAM BOODHOO - MUR 26,000,000.00

25 JUN MRA (SCHEDULE 3 PAYMENTS) - MUR 28,064,830.00

Total - MUR 804,087,102.93

The trail reveals that the remaining amount was deposited in a trust account held by notary Anusha Mungur on behalf of Armand Apavou. Legal counsels and transaction advisors were paid by the notary as per the terms agreed by their client, Armand Apavou. VERDE, one of the advisors retained by Armand Apavou having offered its services since 2022 against a success fee, was paid 5% of the transaction value, amounting to MUR 120 m. However it is claimed that the payment also includes unpaid charges for services offered to other entities of the group spreading over last 3 years.

The challenges for FCC

Back in 2022. the initial offer from Armand Apavou stood at EUR 55 m (MUR 2.5 bn as per then rate of exchange of MUR 45.8). The offer was then revised downwards to EUR 48 m. While Independent directors consistently maintain that their decision was to effect the acquisition for 70% of the estimated value by ELEVANTE of MUR 3 bn. Browsing through the timeline of various valuations we observe that in November 2022 AESTIMA (retained by Armand Apavou) estimated the value of EASTCOAST at MUR 3.2bn, while MIC’s valuer ELEVANTE’s estimates stood at MUR 3.1bn. In 2024 AESTIMA’s valuation stood at MUR 3.44 while ELEVANTE shifted its methodology from income generated to open market value, thereby reviewing its valuation to MUR 3.5 bn. With Independent Directors maintaining they never ordered / approved any revaluation by ELEVANTE and were unaware of any revaluation report, the conundrum only gets thicker.

Authentication of the genuine minutes of proceedings in a court of law would be a tough call for the prosecution. The one bearing the digital signature of then chairman would surely be challenged given it received a backdated approval from Mark Florman who was himself absent at the 63rd board meeting. Given FCC is treating everybody as a suspect, whose version will pass the credibility test? Averment by governor SIthanen during a talkshow that he has had access to files of the MIC does pose concern over the lack of diligence at the helm of the BOM.

One of the reasons why hardly any of our politicians or their cronies have never been convicted despite blatant evidence of involvement in scams, its precisely due to the unflinching fad of enforcement agencies to work backwards as to meet their desired result, often politically tainted. The EASTCOAST investigation will be another test case for the FCC and other law enforcement agencies. Are they capable of identifying a crime much bigger than what is being fed to them? Will FCC find its way through the Labyrinth of deadalus or will it meltdown like his son Icarius for getting too close to the Sun? Time will tell.